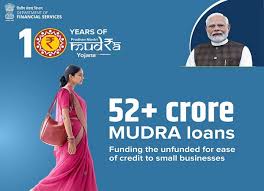

Welcome to PM Mudra Yojna

Issued in Public Interest by Gorvment of india

We are committed to delivering value-driven solutions that transform businesses and inspire innovation.

To be an integrated financial and support services provider par excellence benchmarked with global best practices and standards for the bottom of the pyramid universe for their comprehensive economic and social development.

To create an inclusive, sustainable and value based entrepreneurial culture, in collaboration with our partner institutions in achieving economic success and financial security.

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans up to ₹30 lakh (for those entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category) to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY.

These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through this portal

Under the aegis of PMMY, MUDRA has created four products namely Shishu, Kishore, Tarun and Tarun Plus to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth.